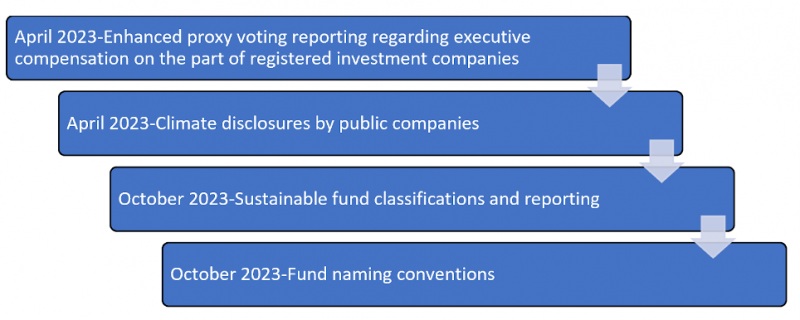

SEC sustainable investing and corporate disclosure rulemaking agenda for 2023

Sources: Securities and Exchange Commission Agency Rule List-Fall 2022. Sustainable Research and Analysis LLC.

The SEC has four proposed rules for 2023 directly affecting sustainable investing and climate disclosures

On January 4, 2023, the Office of Information and Regulatory Affairs, a division of the Office of Management and Budget, released the Fall 2022 Unified Agenda of Regulatory and Deregulatory Actions, which included contributions related to the Securities and Exchange Commission (SEC) and short- and long-term regulatory actions that administrative agencies plan to take.

The SEC’s planned rulemaking schedule for 2023 includes the publication of 23 proposed rules and the anticipated adoption of 29 final rules. In terms of final rulemaking, the SEC intends to finalize four proposed rules directly affecting sustainable investing and climate disclosures that are expected to be issued in April and October of this year.

Regulations for enhanced proxy voting and climate disclosures targeted for April 2023

In April, the SEC is scheduled to finalize rules involving enhanced executive compensation proxy voting disclosures on the part of registered investment companies as well as climate disclosures by public companies. Regarding the former, the intention is to make information easier to collect and analyze. As for climate disclosures, the proposed rule would enhance and standardize the climate-related disclosures provided by public companies, including climate-related risks and opportunities. Under the proposed rule, a registrant would be required to provide disclosures about greenhouse gas (GHG) emissions, including attestation for Scope 1 and Scope 2 disclosures, certain financial statement disclosures, and qualitative and governance disclosures within a companies registration statements and annual reports (e.g., Form 10-K). Excluding small reporting companies, Scope 3 emissions would also be subject to disclosure rules under certain conditions.

Mandatory reporting regulations for all “ESG Investment Products” coming in October 2023

In October, the SEC intends to finalize rules requiring financial institutions to provide additional information regarding the ESG investment practices of investment managers offering sustainable investment products. The proposed rules and form amendments seek to facilitate enhanced disclosure of ESG issues to clients and shareholders and are designed to create a consistent, comparable, and decision-useful regulatory framework for ESG advisory services and investment companies to inform and protect investors while facilitating further innovation in this evolving area of the asset management industry. In addition, the SEC is proposing to amend its fund “Names Rule”, as it relates to the application of terms such as “ESG” or “Sustainable,” the proposal would extend the “Names Rule” to encompass fund strategies, including sustainable investing strategies covering 100% of portfolio assets.

Although the regulations have not been finalized, investors and other stakeholders can begin preparing their strategies for the eventual out of these new rules

Various concerns relating to the proposed rules aside, the proposed rules are intended to promote transparency, enhance and standardize climate-related disclosures provided by public companies, as well as clear up confusion and misunderstanding on the part of investors as well as other stakeholders regarding the various types of sustainable investing strategies that have been adopted by mutual funds and ETFs along with their financial and non-financial outcomes, if any. The unprecedented growth in sustainable investing in the US starting in 2019, including a dramatic expansion in the number and variety of sustainable investing products, and proliferation in the number of firms offering such products, has contributed to confusion and misunderstanding on the part of investors as well as other stakeholders regarding the various types of sustainable investing strategies and their outcomes. This has led to concerns and exposed stakeholders to challenges, in particular, for investment managers, asset owners, regulators, investors as well as financial intermediaries. The absence of clear definitions, lack of investment product clarity, and a disclosure gap have been contributing factors. With some modifications, the proposed fund categories, definitions, and the enhanced layered disclosure approach proposed by the SEC will address some of these core concerns and create a more consistent, comparable, and decision-useful regulatory framework to inform and protect investors. As used here, sustainable investing is an umbrella term covering various sustainable investing approaches, including values-based investing that relies on inclusions and exclusions, also referred to as ethical, religious, social or responsible investing, thematic investing, impact investing, ESG integration, proxy voting, and stakeholder engagement.

Research by Sustainable Research and Analysis. Source: https://www.sustainablinvest.com